Preliminary results 2024 | audius continues to grow by 7.4% in 2024

+49 (7151) 369 00 - 364

Biographie

Since 2020, Melanie Ilg is supporting audius in the area of investor relations and corporate development.

Normaler Abstand nach oben

Normaler Abstand nach unten

audius continues to grow by 7.4% in 2024 / preliminary figures confirm forecast / very strong operating cash flow

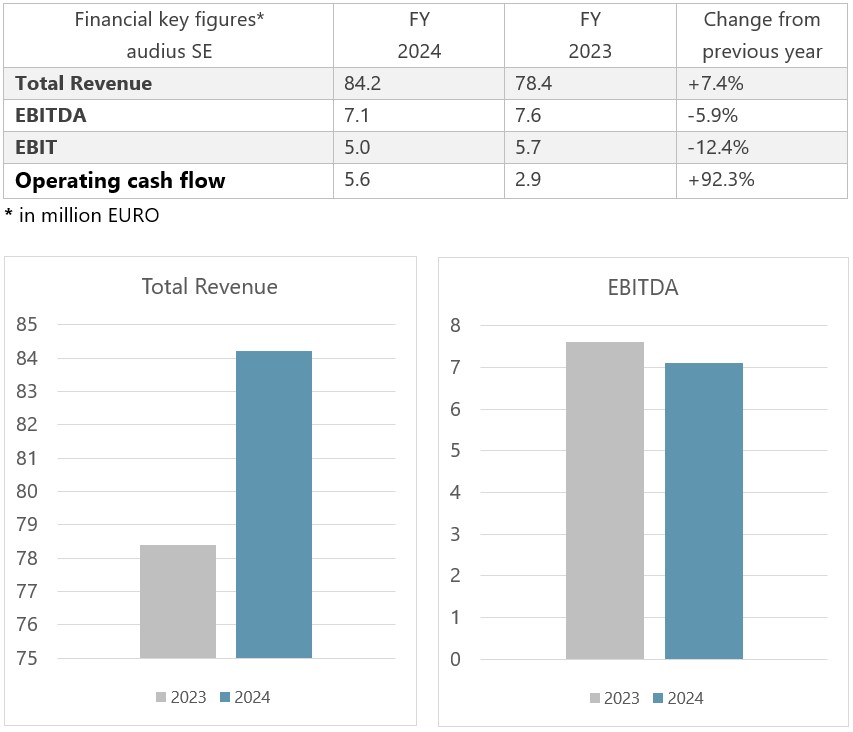

- Total revenue in financial year 2024 increases by 7.4% to EUR 84.2 million (previous year: EUR 78.4 million)

- Earnings figures burdened by investments in new business areas

- EBITDA of EUR 7.1 million nevertheless only slightly below previous year's level (previous year: EUR 7.6 million)

- Very strong operating cash flow of EUR 5.6 million

audius SE has managed to achieve another record year in terms of total revenue, even in the challenging market environment of the 2024 financial year. The strong figure of 7.4% was achieved purely through organic growth. At the same time, the key earnings figures declined slightly due to investments in new business areas affecting earnings. Adjusted for these, audius would also have achieved a new record result.

According to preliminary unaudited figures, the audius Group achieved a total revenue of EUR 84.2 million, an increase of 7.4% (previous year: EUR 78.4 million). The operating result (EBITDA) amounted to EUR 7.1 million and was therefore slightly below the previous year's figure (previous year: EUR 7.6 million). Despite the weak first quarter, a general increase in costs and significant investments in the two new business areas Mobile Device Management and Amazon Web Services (public cloud platform), the EBITDA margin reached 8.5%.

EBIT amounted to EUR 5.0 million due to increased depreciation and amortization on subsequent performance-related purchase price payments.

Cash flow from operating activities developed very positively, reaching EUR 5.6 million (previous year: EUR 2.9 million), the highest figure in the company's history. As a result, cash and cash equivalents increased to EUR 11.0 million (previous year: EUR 10.1 million) as at the balance sheet date, despite loan repayments and payments for subsequent purchase price payments and the dividend. The equity ratio remained at a very solid level in line with the previous year (previous year 63.3%).

The order backlog increased significantly compared to 2023 and amounted to EUR 79.3 million as at the balance sheet date (previous year: EUR 56.8 million). audius therefore considers itself to be well equipped.

For the current year, audius is again expecting significant growth and a positive development of all key financial figures. The company will announce the exact forecast when it publishes its annual report.

The audius Group's annual report with the final figures will be published on April 29, 2025 at our website.