Shares

Key financial figures and information on IT investment:

What you can expect from the audius share.

+49 (7151) 369 00 - 364

Biographie

Since 2020, Melanie Ilg is supporting audius in the area of investor relations and corporate development.

audius Shares

aktie

Normaler Abstand nach oben

Normaler Abstand nach unten

Dividend Development

dividenden-entwicklung

Share and Trading Data

handelsdaten

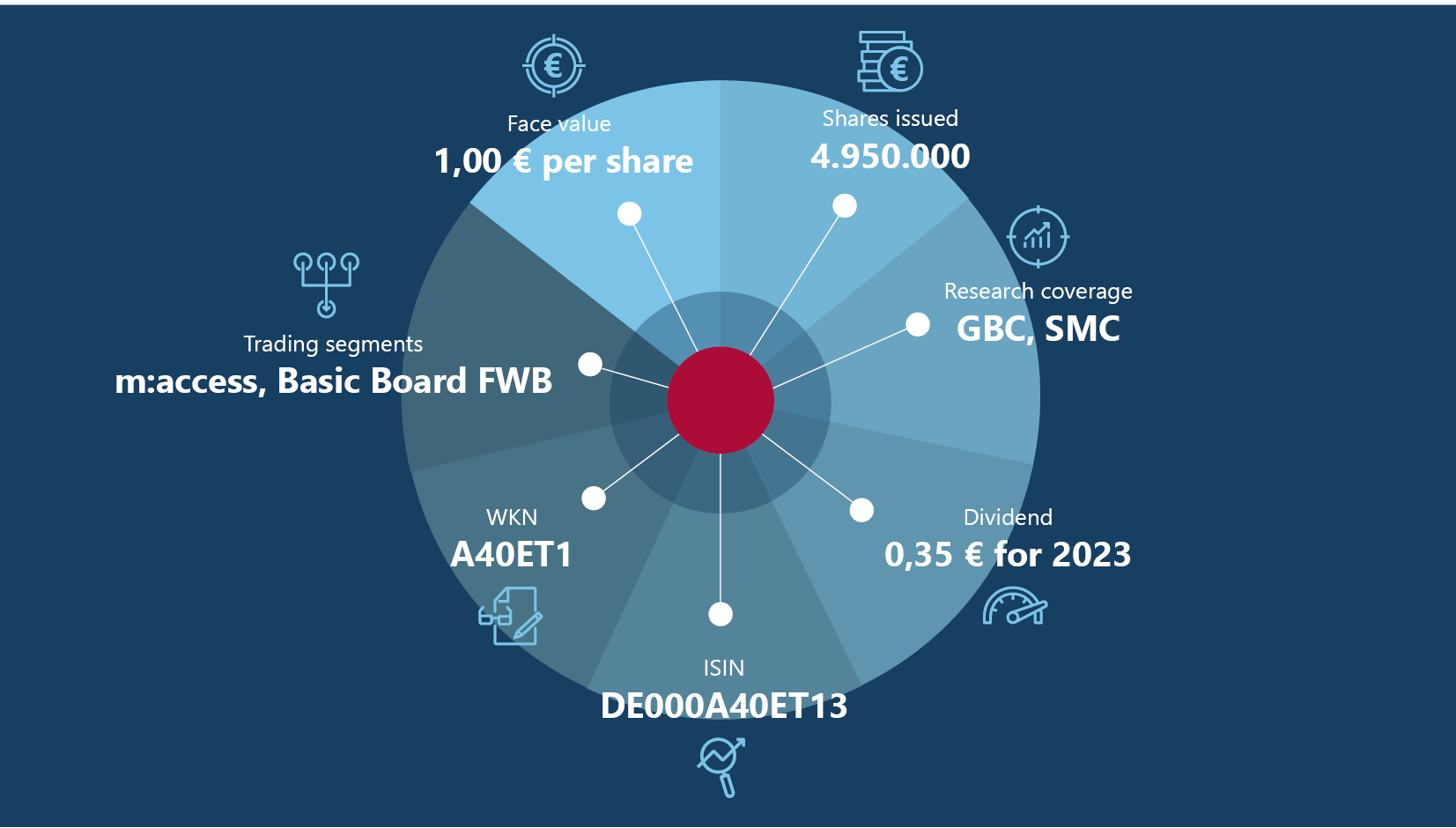

- WKN: A40ET1

- Ticker: 3ITN

- ISIN: DE000A40ET13

- Listed since: 2006

- Stock exchange segment: Over-the-counter (OTC) market

- Type of shares: Registered shares

- Shares issued: 4,950,000

- Subscribed capital: 4,950,000 euros

- Face value: 1.00 euro per share

- Free float: 17.94%

- Dividend: 35 cents for 2023

- Stock exchanges: Xetra, Tradegate, Frankfurt, Munich, Stuttgart, Berlin, Dusseldorf

- Trading segments: m:access, Basic Board FWB

- Designated sponsor: BankM AG

- Research coverage: SMC (target price: 20.00 euros), GBC (target price: 21.50 euros)

Share Chart

aktienchart

Analyst and Press Views of audius

audius' growth course will continue in 2025

audius ranked among TOP 15 leading IT service companies in Germany.

Forecast achieved in 2022 - further growth planned for 2023.

audius SE - Increased targets exceeded again.

audius SE - Sales and earnings growth continued, forecasts confirmed.

Forecast confirmed despite rising costs - fully on target after 9 months.

Increase in the sales and earnings forecast following a successful first half.

audius SE - Targets for 2022 raised after strong half-year.

Good start to the current year – No effects from the Ukraine war so far.

audius SE - Good Q1 figures and unchanged positive outlook.

2022 continued growth - possible acquisitions offer additional potential.

audius SE - Preliminary figures more than twice the forecast

audius SE - Acquisition complements high-growth area.

audius SE - Forecast for 2021 raised for the third time.

A network full of growth.

audius SE - Forecast raised again after strong half-year figures.

audius SE: 100 million euros sales target?

audius SE - Growth in profits clearly on track for record.

audius SE - Sales and earnings forecast raised after strong start to the year.

audius share / dividend and growth potential for the first time.

audius SE - Contribution of audius Group leads to record result - Further acquisitions to follow.

audius SE - Expectations clearly exceeded with a strong fourth quarter.

audius SE - High earnings growth continued.