+49 (7151) 369 00 - 364

Biographie

Since 2020, Melanie Ilg is supporting audius in the area of investor relations and corporate development.

Normaler Abstand nach oben

Normaler Abstand nach unten

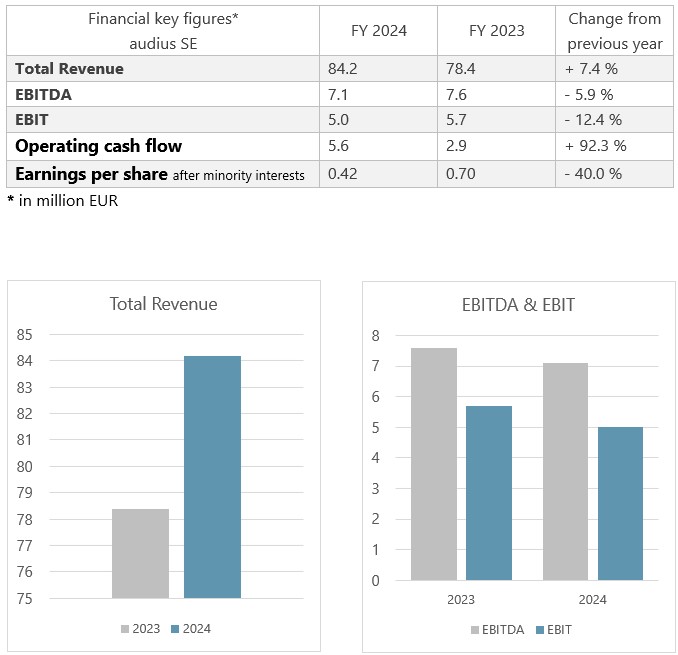

- Total revenue in fiscal year 2024 rose by 7.4% to EUR 84.2 million (previous year: EUR 78.4 million)

- Earnings figures impacted by investments in new business areas

- EBITDA and EBIT nevertheless only slightly below previous year's level

- Operating cash flow almost doubled to EUR 5.6 million

- audius expects total revenue of more than EUR 90 million with a slight increase in EBITDA

- Dividend proposal to the Annual General Meeting: 20 cents per share

Despite continuing challenging conditions, the 2024 financial year was another year of growth for audius.

Key financial figures were slightly down due to a general increase in costs and investments in the two new business areas mobile device management and Amazon Web Services (public cloud platform) that impacted earnings. Adjusted for these factors, audius would have achieved a new record result at the earnings level.

According to audited figures, audius succeeded in increasing its total revenue by 7.2 % to EUR 84.2 million compared to the previous year on a purely organic basis.

In fiscal year 2024, consolidated group revenue amounted to EUR 83.9 million, corresponding to an increase of 7.2 % compared to the previous year (previous year: EUR 78.2 million). The increase from 2022 to 2023 was 6.7 %.

Operating profit (EBITDA) amounted to EUR 7.13 million, slightly below the previous year's figure (previous year: EUR 7.58 million). Despite the weak first quarter and significant investments in the two new above-mentioned areas, the EBITDA margin reached 8.5 %.

Consolidated net income amounted to EUR 2.8 million, compared with EUR 3.5 million in the previous year. This includes minority earnings of EUR 683 thousand, bringing the consolidated net income attributable to the shareholders of audius SE to EUR 2.086 million.

Earnings per share after minority earnings amounted to 42 cents.

audius almost doubled its cash flow from operating activities to EUR 5.6 million in the past fiscal year, an increase of 92 %, reaching a new high (previous year: EUR 2.9 million).

The number of employees rose significantly in the fourth quarter and stood at around 700 at the end of the year.

Outlook

For the current fiscal year 2025, the Management Board is planning a significant purely organic increase in total revenue in all three business segments to a total of more than EUR 90 million. audius expects EBITDA to show a slight improvement on the previous year's figure of EUR 7.1 million.

The strong order backlog of EUR 79.3 million as of December 31, 2024, which increased again compared to the previous year, provides the company with the necessary momentum to achieve this.

However, earnings in the first half of the current fiscal year will be impacted by ongoing investments in new business areas and services, which were unable to achieve optimal capacity utilization quickly enough in the current economic environment.

The company also confirms its medium-term forecast. The published target for the end of 2026 is growth in total revenue to more than EUR 115 million. This growth forecast includes both organic and inorganic growth.

An important step toward achieving these goals is the broader focus of the mobile communications division toward telecommunications as a whole. Consequently, the audius Group has renamed the division “mobile communications” into “telecommunications.” This reflects the significant shift in focus of this division over the past few years, which has resulted from the politically driven expansion of the entire network infrastructure in Germany. Orders relating to mobile communications expansion with 4-6G are supplemented by projects involving DSL connections via fiber optic connections, which are sustainably filling the project pipeline.

The Management Board and Supervisory Board will propose a dividend of 20 cents per share for the fiscal year to the Annual General Meeting on June 25, 2025. As in the past, this is based on half of the consolidated net income after minority interests.

The audius Group's annual report will be available on the company's website from April 29, 2025 on.